- News

- Business News

- India Business News

- 100% I-T sop to end for some NGO donations

Trending

This story is from March 4, 2017

100% I-T sop to end for some NGO donations

Mumbai: Donations made to hundreds of projects carried out by NGOs across the country will no longer be eligible for a 100% income tax (I-T) deduction in the hands of the donor from April 1. While tax savings are not the main purpose, if donations are made in March towards eligible projects, then donors comprising salaried employees could reap an I-T benefit.

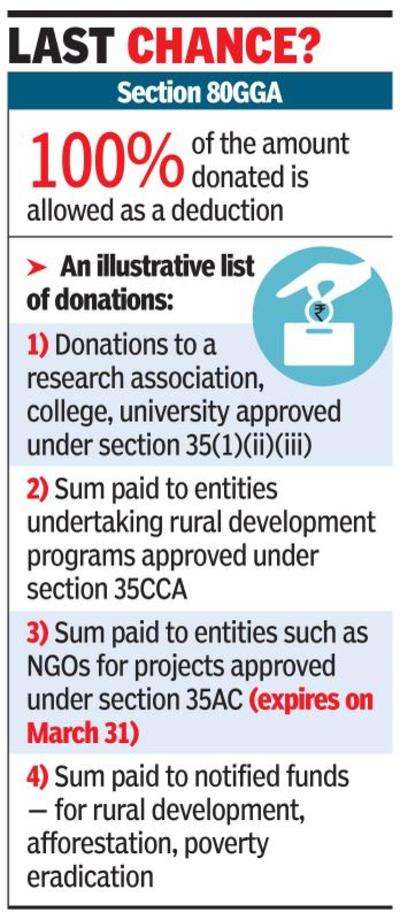

At present, donations made for specific projects run by NGOs that have been certified under section 35AC entitle the donor to a 100% I-T deduction under section 80GGA in respect of the donated amount.

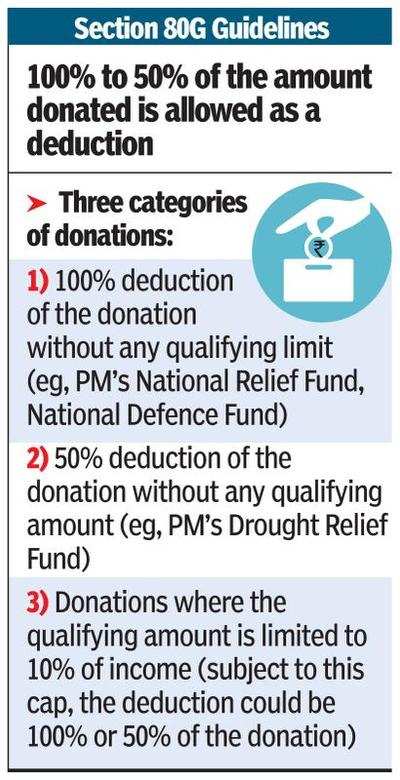

However, section 35AC has a sunset clause which expires this March. Section 80GGA is not as widely known as section 80G, which permits a 100% I-T deduction in respect of certain donations (such as PM’s National Relief Fund) and a 50% I-T deduction in most other cases (see table).

“Taxpayers who do not earn income under the head ‘profits and gains of business and profession’, such as salaried employees, can claim the benefit of section 80GGA. While the employer cannot consider the donations made, while computing tax to be deducted at source against salary income, the employee can claim the benefit of the same in his I-T return and claim an I-T refund, if applicable,” says Pradeep Mahtani, director, HelpYourNGO Foundation.

Notifications are issued by the finance ministry from time to time, certifying the projects that are eligible under section 35AC, the period of eligibility and also the total cost of the eligible project. For instance, as regards NGOs registered in Maharashtra, these include projects by Magic Bus (skill development and livelihood programme), Association of Palliative Care (for a palliative care centre), Foundation of Promotion for Sports and Games (Olympic Gold Quest project) and Mesco (educational scholarships).

HelpYourNGO, an online donation platform, has on its portal 45 NGOs that run 90 projects eligible under section 35AC, These include some well known names such as Akshaya Patra’s midday meals, projects by Childline and People for Animals.

In view of the sunset clause, a government-appointed national committee — which approves projects that would be eligible under section 35AC — had ceased to accept requests after December last year. “Donation stems from fundamental reasons, which are deep-rooted among each donor whether that’s joy, guilt, remembrance or duty. However, everyone does think of saving I-T after having donated. Just like the insurance and the investment industry, which makes people aware of I-T savings available to them, for donations it is incumbent upon NGOs to make people aware of taxes they can save as a result of the donation they have made,” says Dhaval Udani, founder of Danamojo, a payments platform for NGOs.

Perhaps awareness of a 100% I-T deduction for donations made to section 35AC-eligible projects has been low. HelpYourNGO did a dipstick sample survey of 12 NGOs, for which data was readily available. It showed that the percentage of donations towards 35AC-eligible projects as compared to total donations received by NGOs has declined from 14.7% in fiscal 2014-15 to 7.9% in the next fiscal.

Deval Sanghavi, partner and co-founder at Dasra, a strategic philanthropy foundation, points out, “Our experience has shown that donors see the I-T deduction more as a government certification, which in essence states the organisation is compliant with laws and adheres to mission-driven principles vis-à-vis a giver donating more because of the I-T deduction.”

The number of individuals who donate money to charity has shown a rise in India. As many as 203 million Indians donated money during 2015, opposed to just 183 million in 2014, according to the World Giving Index 2016.

At present, donations made for specific projects run by NGOs that have been certified under section 35AC entitle the donor to a 100% I-T deduction under section 80GGA in respect of the donated amount.

However, section 35AC has a sunset clause which expires this March. Section 80GGA is not as widely known as section 80G, which permits a 100% I-T deduction in respect of certain donations (such as PM’s National Relief Fund) and a 50% I-T deduction in most other cases (see table).

“Taxpayers who do not earn income under the head ‘profits and gains of business and profession’, such as salaried employees, can claim the benefit of section 80GGA. While the employer cannot consider the donations made, while computing tax to be deducted at source against salary income, the employee can claim the benefit of the same in his I-T return and claim an I-T refund, if applicable,” says Pradeep Mahtani, director, HelpYourNGO Foundation.

A chartered accountant says, “In fact, if there has been a short deduction of tax at source and advance tax has not been paid by the salaried employee, by making donations eligible for I-T deduction up to March 31, the salaried taxpayer could mitigate his I-T penalty. Donors should ensure that they get the appropriate receipt.”

Notifications are issued by the finance ministry from time to time, certifying the projects that are eligible under section 35AC, the period of eligibility and also the total cost of the eligible project. For instance, as regards NGOs registered in Maharashtra, these include projects by Magic Bus (skill development and livelihood programme), Association of Palliative Care (for a palliative care centre), Foundation of Promotion for Sports and Games (Olympic Gold Quest project) and Mesco (educational scholarships).

HelpYourNGO, an online donation platform, has on its portal 45 NGOs that run 90 projects eligible under section 35AC, These include some well known names such as Akshaya Patra’s midday meals, projects by Childline and People for Animals.

In view of the sunset clause, a government-appointed national committee — which approves projects that would be eligible under section 35AC — had ceased to accept requests after December last year. “Donation stems from fundamental reasons, which are deep-rooted among each donor whether that’s joy, guilt, remembrance or duty. However, everyone does think of saving I-T after having donated. Just like the insurance and the investment industry, which makes people aware of I-T savings available to them, for donations it is incumbent upon NGOs to make people aware of taxes they can save as a result of the donation they have made,” says Dhaval Udani, founder of Danamojo, a payments platform for NGOs.

Perhaps awareness of a 100% I-T deduction for donations made to section 35AC-eligible projects has been low. HelpYourNGO did a dipstick sample survey of 12 NGOs, for which data was readily available. It showed that the percentage of donations towards 35AC-eligible projects as compared to total donations received by NGOs has declined from 14.7% in fiscal 2014-15 to 7.9% in the next fiscal.

Deval Sanghavi, partner and co-founder at Dasra, a strategic philanthropy foundation, points out, “Our experience has shown that donors see the I-T deduction more as a government certification, which in essence states the organisation is compliant with laws and adheres to mission-driven principles vis-à-vis a giver donating more because of the I-T deduction.”

The number of individuals who donate money to charity has shown a rise in India. As many as 203 million Indians donated money during 2015, opposed to just 183 million in 2014, according to the World Giving Index 2016.

End of Article

FOLLOW US ON SOCIAL MEDIA