- News

- Business News

- India Business News

- Supreme Court quashes stringent RBI circular against defaulters

Trending

This story is from April 3, 2019

Supreme Court quashes stringent RBI circular against defaulters

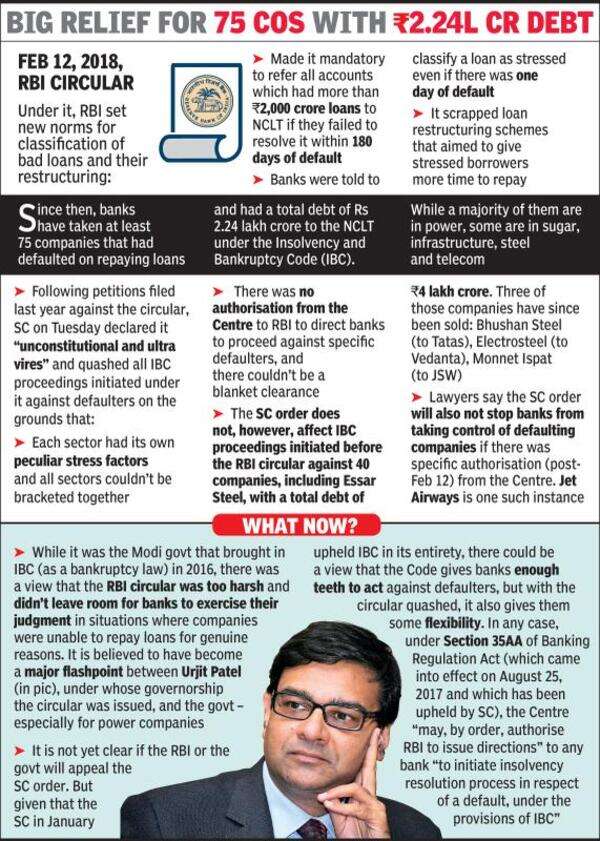

In a big setback to efforts for recovery of bad debts of companies owing Rs 2,000 crore or more to banks, the Supreme Court on Tuesday quashed the RBI’s February 12, 2018, circular, which directed banks to move against defaulters under the Insolvency and Banking Code (IBC) on their failure to pay up within 180 days from March 1, 2018.

(File photo)

Key Highlights

- Supreme Court quashed the RBI circular, which directed banks to move against defaulters on their failure to pay up within 180 days from March 1, 2018

- The top court also quashed all IBC proceedings initiated by banks under the RBI circular against defaulters

NEW DELHI: In a big setback to efforts for recovery of bad debts of companies owing Rs 2,000 crore or more to banks, the Supreme Court on Tuesday quashed the RBI’s February 12, 2018, circular, which directed banks to move against defaulters under the Insolvency and Banking Code (IBC) on their failure to pay up within 180 days from March 1, 2018.

A bench comprising Justices R F Nariman and Vineet Saran also quashed all IBC proceedings initiated by banks under the RBI circular against defaulters.

Thus, the apex court turned the clock back to March 1, 2018, giving a huge relief to defaulters who owe Rs 2,000 crore or more to banks. “All actions taken under the said circular, including action by which the Insolvency Code has been triggered, must fall along with the said circular,” it said.

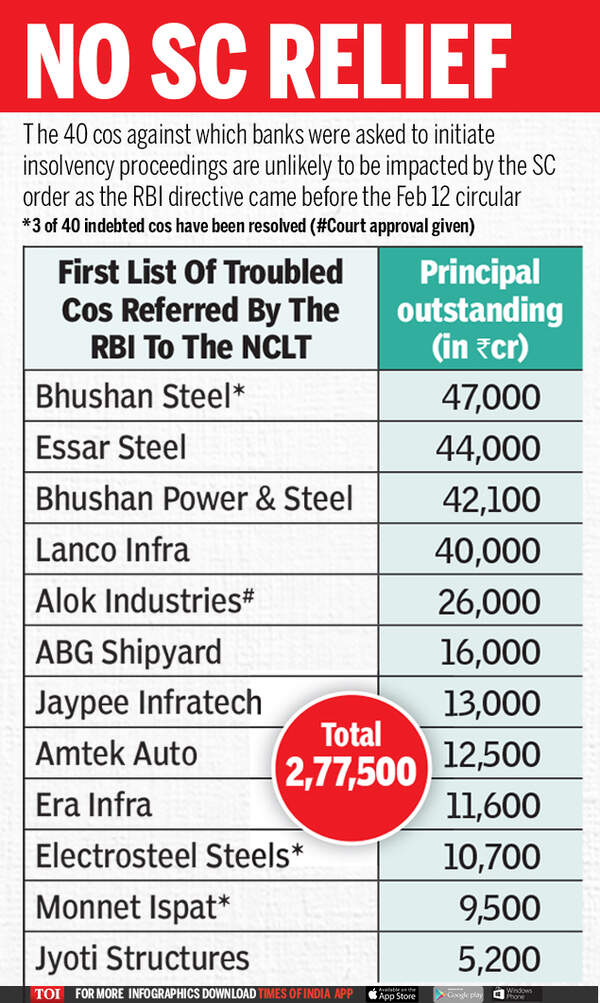

One such example is the IBC proceedings launched by a State Bank of India-led consortium against Essar Steel, which on culmination of proceedings is set to be taken over by Arcelor Mittal. Essar Steel had a debt of Rs 45,000 crore. Writing the 84-page judgment, Justice Nariman accepted the main plea of senior advocate A M Singhvi, who appeared for the Association of Power Producers and argued that peculiarity of stress factors in each sector would not permit the RBI to bracket defaulting companies in different sectors for proceeding under IBC. Singhvi’s arguments were adopted by other counsel who appeared for defaulting companies operating in varied sectors including telecom, steel, infrastructure, sports infrastructure, sugar, fertilisers and shipyards.

SC: Circular illegal due to lack of Central authorisation

Although the SC accepted senior advocate Rakesh Dwivedi’s arguments and upheld the constitutional validity of Section 35AA of the Banking Regulation Act, which empowers the Centre to exercise the power itself or authorise the RBI to direct banks to proceed against specific defaulters, it found the February 12 circular to be illegal as there was no such authorisation from the Centre to RBI to direct banks to proceed against defaulters by specifying a default limit and a 180-day period.

“The Banking Regulation Act specifies that the central government is either to exercise powers along with the RBI or by itself. The role assigned by Section 35AA, when it comes to initiating the insolvency resolution process under the Insolvency Code, is thus, important. Without authorisation of the central government, obviously, no such directions can be issued,” the bench said.

Referring to Section 35AA, the bench said, “It is clear that directions that can be issued by the RBI (to banks) under Section 35AA (with authorisation from Centre) can only be in respect of specific defaulters by specific debtors. This is also the understanding of the central government when it issued the notification on May 5, 2017, which authorised the RBI to issue such directions only in respect of ‘a default’ under the Code. Thus, any direction in respect of debtors generally, would be ultra vires (in violation of) Section 35AA.”

Justices Nariman and Saran also said the RBI circular “applies to banking and nonbanking institutions alike, as banking and non-banking institutions are often in a joint lenders’ forum which jointly lend sums of money to debtors. Such non-banking financial institutions are, therefore, inseparable from banking institutions insofar as the application of the RBI circular is concerned”.

Having clarified this, the bench said proceedings initiated by both banking and non-banking financial institutions under the circular would have to be quashed along with the circular.

A bench comprising Justices R F Nariman and Vineet Saran also quashed all IBC proceedings initiated by banks under the RBI circular against defaulters.

Thus, the apex court turned the clock back to March 1, 2018, giving a huge relief to defaulters who owe Rs 2,000 crore or more to banks. “All actions taken under the said circular, including action by which the Insolvency Code has been triggered, must fall along with the said circular,” it said.

However, this ruling will not affect initiation of IBC proceedings by banks against big defaulters taken before, or independent of, the RBI circular.

One such example is the IBC proceedings launched by a State Bank of India-led consortium against Essar Steel, which on culmination of proceedings is set to be taken over by Arcelor Mittal. Essar Steel had a debt of Rs 45,000 crore. Writing the 84-page judgment, Justice Nariman accepted the main plea of senior advocate A M Singhvi, who appeared for the Association of Power Producers and argued that peculiarity of stress factors in each sector would not permit the RBI to bracket defaulting companies in different sectors for proceeding under IBC. Singhvi’s arguments were adopted by other counsel who appeared for defaulting companies operating in varied sectors including telecom, steel, infrastructure, sports infrastructure, sugar, fertilisers and shipyards.

SC: Circular illegal due to lack of Central authorisation

Although the SC accepted senior advocate Rakesh Dwivedi’s arguments and upheld the constitutional validity of Section 35AA of the Banking Regulation Act, which empowers the Centre to exercise the power itself or authorise the RBI to direct banks to proceed against specific defaulters, it found the February 12 circular to be illegal as there was no such authorisation from the Centre to RBI to direct banks to proceed against defaulters by specifying a default limit and a 180-day period.

“The Banking Regulation Act specifies that the central government is either to exercise powers along with the RBI or by itself. The role assigned by Section 35AA, when it comes to initiating the insolvency resolution process under the Insolvency Code, is thus, important. Without authorisation of the central government, obviously, no such directions can be issued,” the bench said.

Referring to Section 35AA, the bench said, “It is clear that directions that can be issued by the RBI (to banks) under Section 35AA (with authorisation from Centre) can only be in respect of specific defaulters by specific debtors. This is also the understanding of the central government when it issued the notification on May 5, 2017, which authorised the RBI to issue such directions only in respect of ‘a default’ under the Code. Thus, any direction in respect of debtors generally, would be ultra vires (in violation of) Section 35AA.”

Justices Nariman and Saran also said the RBI circular “applies to banking and nonbanking institutions alike, as banking and non-banking institutions are often in a joint lenders’ forum which jointly lend sums of money to debtors. Such non-banking financial institutions are, therefore, inseparable from banking institutions insofar as the application of the RBI circular is concerned”.

Having clarified this, the bench said proceedings initiated by both banking and non-banking financial institutions under the circular would have to be quashed along with the circular.

End of Article

FOLLOW US ON SOCIAL MEDIA