- News

- Business News

- India Business News

- How much is Air India really worth? Investment bankers weigh in

Trending

This story is from July 9, 2017

How much is Air India really worth? Investment bankers weigh in

Air India enjoys a near-monopoly in ground handling as Indian rules allow only three players in each airport and AI is one among the three in every airport in India.

There is no doubt about the difficulties in turning Air India around. Managing public opinion, when selling the national flag carrier with strong and litigious trade unions, is foremost.

Air India’s Staff Colony-II in Kalina is separated from the Mumbai International Airport to its north by a public road and the airport’s boundary wall. The tree-lined road, aptly named Air India Road, passes the Air India Sports Club and one more colony of the airline, as well as an Air Force colony and a graveyard that lies inside the airport, skirting the boundary wall all the way to Kurla.

Inside the colony (Air India has two more colonies in the Kalina area), rows of buildings are arranged along with parks for children, a playground and plenty of greenery. The hunky-dory feel, however, gives way when one takes a closer look at the buildings. The ground-floor flats, which were prone to flooding, are unoccupied. The Mithi river flows under the airport and to the east of the colony. After the devastation of the 2005 Mumbai floods, when doors had to be broken to rescue kids trapped inside, the ground-floors flats were abandoned.

They look haunted now. Adding to the atmosphere, just across the airport wall stands a single aircraft — permanently parked, the United Breweries logo clearly visible from the colony — reminding all about liquor baron Vijay Mallya, and how an airline (Kingfisher) can sink and take a lot more down with it. The colony is in many ways a nice analogy for Air India — some nice parts, some untouchables and a looming uncertainty. The airline has some great assets (land worth Rs. 8,000 crore), some profitable businesses in subsidiaries (budget operator Air India Express which connects India to the Gulf turned in a profit of Rs.297 crore last fiscal), huge debt on its books (Rs. 53,000 crore) and therefore a loss-making mainline operation.

Can privatisation turn around the government owned flag-carrier? Does Indigo, the crown jewel of Indian aviation sector today, or the Tatas, who had started the airline seven decades back, have it in them to take on the challenge (Indigo has clarified that they would be interested in Air India’s international operations, including Air India Express)? There can be many answers. Here’s one:

Can privatisation turn around the government owned flag-carrier? Does Indigo, the crown jewel of Indian aviation sector today, or the Tatas, who had started the airline seven decades back, have it in them to take on the challenge (Indigo has clarified that they would be interested in Air India’s international operations, including Air India Express)? There can be many answers. Here’s one:

Maharaja, Name Your Price

There is no doubt about the difficulties in turning Air India around. Managing public opinion, when selling the national flag carrier with strong and litigious trade unions, is foremost. The government started the work early by pressing ministers, secretaries and the

Veteran investment banker Ajay Garg, founder and managing director of Equirus Capital, feels Air India should have been privatised with its market share intact. Today it has only 14 per cent of the domestic market and 44 per cent of the international (among Indian carriers). “In a high operating cost business, once you lose market share it is difficult to come back. Air India should have been privatised when the aviation sector was opened up.” He takes the example of how MTNL and BSNL would have fetched a huge valuation if privatised at the time of opening up the telecom sector. Even if opinion is managed, pathway to a fair value estimate for the airline is muddied.

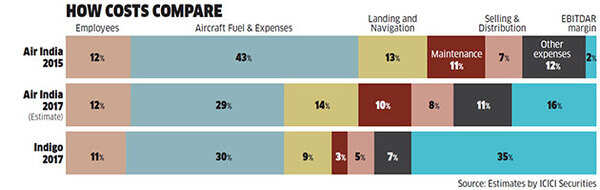

Air India is not listed and has not published its annual report for the last two financial years. In a report dated June 30, ICICI Securities analyst Anshuman Deb estimated the earnings before interest, tax, depreciation, amortisation and rent (EBITDAR) of Air India for 2016-17 at Rs. 3,500-4,000 crore using older numbers and accounting for the drop in fuel prices in the last two years that has buoyed the industry. Deb has used the ratio of EBITDAR margins to enterprise value (EV, which is based on share price) of listed aviation entities like Jet Airways (4) and Indigo (7.6). Applying the same ratios to the Air India EBITDAR, he arrived at an enterprise value for Air India in the range of Rs. 16,000 crore to Rs. 30,000 crore. The average EBITDAR to EV value for full-service Asian flag carriers is 6.5.

“All this will, of course, change when the numbers are available,” Deb adds. Then, EBITDAR to EV is just one of the methods. Another way to value Air India would be based on depreciated assets value, physical immovable assets and its fleet of 118 wide-body, narrow-body and ATR aircraft. It includes 23 Boeing 787 Dreamliners. Air India owns 77 planes, and around 20 each are on sale-and-leaseback and dry lease. One rough estimate by a senior investment banker who did not want to be identified suggests Air India has assets worth Rs. 45,000 crore.

“All this will, of course, change when the numbers are available,” Deb adds. Then, EBITDAR to EV is just one of the methods. Another way to value Air India would be based on depreciated assets value, physical immovable assets and its fleet of 118 wide-body, narrow-body and ATR aircraft. It includes 23 Boeing 787 Dreamliners. Air India owns 77 planes, and around 20 each are on sale-and-leaseback and dry lease. One rough estimate by a senior investment banker who did not want to be identified suggests Air India has assets worth Rs. 45,000 crore.

Nitin Bhasin, head of research at Ambit Equity, says the sheer value of Air India’s fully owned planes, taking an average of $45 million per aircraft (averaging out prices of narrow and wide-body planes and accounting for depreciation), would be Rs 20,000 crore. Its other assets (real estate alone is worth Rs 8,000 crore) can take its value up to rs 30,000 crore. There are intangible assets like prime landing slots at top airports across the world, but there is no one way of valuing them.

While these slots can be sold, value would differ if taken as a bunch or individually. Amber Dubey, a partner and head of aerospace and defence at KPMG, says there is immense value, not just in the intangibles but also in Air India’s fleet. “Forget about getting fresh landing slots, today you cannot even get new airplanes. To buy planes there is a wait-list of nine years.” Add to that Air India’s pool of engineers and pilots, especially the commanders who occupy the left-hand side seat of the cockpit. Plus, you have membership of Star Alliance, an international alliance of airlines that has Singapore Airlines, Lufthansa, United Airlines and China Air among its many members.

Promise of the Princelings

The debt on the books is another story — or may be the real one — taken on to acquire planes, often carrying a sovereign guarantee from the Government of India. If privatised, the guarantees will have to be replaced with bank guarantees. Bhasin of Ambit estimates that at least half of the debt or around Rs. 25,000 crore is working capital-related, so the government will have to find a way of retiring the remaining debt off its books. One surefire way is to sell the profit-making subsidiaries of the company first.

“In a high operating cost business, once you lose market share, it is difficult to come back. Air India should have been privatised when the aviation sector was opened up” Ajay Garg, founder & MD, Equirus Capital.

The Maharaja has promising progenies, many of which do not have the key personnel legacy issues of an ageing unionised workforce and undefined retirement benefits. Among the subsidiaries, there are highly profitable ones like Air India Express. Also, Air India enjoys a near-monopoly in ground handling as Indian rules allow only three players in each airport and AI is one among the three in every airport in India. For ground handling, apart from its own operation run by a subsidiary, Air India also has a 50:50 joint venture with Singapore Airlines that operates in the top modernised airports. Alliance Air, the regional airline, is also in a separate company and, although not as profitable as Air India Express, it is structured similarly, with low costs.

Then there is the maintenance arm or the MRO with its brand new unit in Nagpur which, if hived off, can easily survive on its own, offering services to all airlines. Edelweiss which, some years back advised SpiceJet for a qualified institutional placement, a fund-raising tool, is one of the growing mid-level investment banks. Vikas Khemani, CEO of Edelweiss Securities Ltd, says: “Air India is a behemoth and needs significant restructuring to make it an efficient and profitable enterprise. Divestment to strategic partners would be a better option as it will allow the freedom to revamp several issues the organisation is facing.” Dubey of KMPG too feels Air India, as it is now structured, is too big to sell as it is, and its assets must be unbundled, just as the Airports Authority did with the privatisation of Mumbai and Delhi airports.

Blind Men & a Large Entity

Whether to sell it unbundled or in its current form, is a question that many feel should have been answered first. And can foreign airlines participate in the process to take over Air India? “The government should have sounded out prospective buyers, asked them what they want and also spoken to us before making an announcement,” says the senior investment banker quoted earlier.

“Divestment to strategic partners would be a better option as it will allow the freedom to revamp several issues the organisation is facing” Vikas Khemani, CEO, Edelweiss Securities.

Qatar Airways is interested in India, and has even made a government-to-government pitch for starting a domestic airline in India. With Emirates and Etihad already invested in India, it is natural for Qatar to seek a foothold in the market. However, it has another objective: directing traffic to the Hamad International Airport that Doha opened in 2014. For the Tatas, of course, there is nostalgia, as they were involved in starting Air India International 70 years back. Even after the nationalisation of the airline, JRD Tata chaired the company’s board till 1978 when he was removed by the Janata Party government. He was back on the board two years later.

Indigo has already raised its hand, albeit with a caveat. Indigo and Air India have been in a bitter battle over fares and other issues and there is severe rivalry among the staff on the ground. Insider sources say the last thing Air India needs at this point is Indigo officials or bankers going through its books. An Air India spokesperson refused to participate in this story or comment on privatisation. Then there is so much disconnect between the lean and low-cost, single aircraft operations of Indigo and Air India’s configuration that the Indigo stock tanked 6% on June 30, after it announced its interest. Indigo promoters did an analyst call on Thursday to allay fears.

Khemani of Edelweiss says: “I don’t think it is about foreign or domestic players. It is about the commitment to run a large operation of this scale and financial muscle to deal with short-term issues. There are several domestic players who have both and will be interested in taking up the challenge.” To buy Air India with all its operations, a global player ideally must also be a member of Star Alliance. For an Indian operator, it can be a bigger challenge. “Maybe Mittal, maybe Reliance,” says Garg of Equirus.

Flag Carriers & their Routes to Privatisation

Privatisation of the national flag carriers can take many routes, starting from public issues of shares to induction of strategic partners. And they can go horribly wrong. Andrea Giurcin, a transport expert at Milan’s Bicocca University, has written a book, The Endless Privatisation of Alitalia, about the process that started in the ’90s and is yet to settle down. Alitalia filed for bankruptcy protection in the US in June.

British Airways (BA) was privatised through a share offering in 1987. Once seen as a successful endeavour, the company is again seen as a laggard, when compared with more nimble-footed competitors. Lufthansa, though listed since the 1960s was privatised in 1994, with shares being widely held. Japan Airlines was also privatised in a similar manner in 1987 and later merged with Japan Air Systems, making it the sixth largest in the world. Companies like BA and German Lufthansa have also participated in the privatisation of other flag carriers, joining them as strategic partners.

BA, for example had an 18% stake in the Australian airline Qantas, which it then sold off in the ’90s. Late last year Lufthansa took over Brussels Airlines, the Belgian flag carrier. It also took over Austrian Airlines in 2009. Flag carriers of France and the Netherlands, Air France and the KLM Royal Dutch Airlines, merged in 2004, effectively privatising Air France. Today the French government owns less than 20% of the airline. Nearer home, Air Sri Lanka saw a divestment of 40% stake to Dubai based Emirates back in 1998. The partnership ended in 2008 and the Emirates-appointed CEO was sacked, as the government took over full control of the airline. However, in the next few years the profitable venture ran up huge losses.

Inside the colony (Air India has two more colonies in the Kalina area), rows of buildings are arranged along with parks for children, a playground and plenty of greenery. The hunky-dory feel, however, gives way when one takes a closer look at the buildings. The ground-floor flats, which were prone to flooding, are unoccupied. The Mithi river flows under the airport and to the east of the colony. After the devastation of the 2005 Mumbai floods, when doors had to be broken to rescue kids trapped inside, the ground-floors flats were abandoned.

They look haunted now. Adding to the atmosphere, just across the airport wall stands a single aircraft — permanently parked, the United Breweries logo clearly visible from the colony — reminding all about liquor baron Vijay Mallya, and how an airline (Kingfisher) can sink and take a lot more down with it. The colony is in many ways a nice analogy for Air India — some nice parts, some untouchables and a looming uncertainty. The airline has some great assets (land worth Rs. 8,000 crore), some profitable businesses in subsidiaries (budget operator Air India Express which connects India to the Gulf turned in a profit of Rs.297 crore last fiscal), huge debt on its books (Rs. 53,000 crore) and therefore a loss-making mainline operation.

“To turn around an old legacy airline that has never made a profit is a challenging job even for the smartest owners… unless given a free hand to make changes, the airline is untouchable,” says Nirmalya Kumar, a former senior executive with the Tatas and now a professor at Singapore Management University and INSEAD Emerging Markets Institute.

Maharaja, Name Your Price

There is no doubt about the difficulties in turning Air India around. Managing public opinion, when selling the national flag carrier with strong and litigious trade unions, is foremost. The government started the work early by pressing ministers, secretaries and the

NITI Aayog into service, talking on behalf of getting rid of the aviation behemoth from the government books. There is more consensus to build still, even within the government. While NITI Aayog is taking the lead, says an investment banker who has started doing the rounds of government offices to get a sense of what the government wants, the Department of Investment and Public Asset Management (DIPAM) is still wearing the protectionist hat. There is no dearth of opinions on Air India.

Veteran investment banker Ajay Garg, founder and managing director of Equirus Capital, feels Air India should have been privatised with its market share intact. Today it has only 14 per cent of the domestic market and 44 per cent of the international (among Indian carriers). “In a high operating cost business, once you lose market share it is difficult to come back. Air India should have been privatised when the aviation sector was opened up.” He takes the example of how MTNL and BSNL would have fetched a huge valuation if privatised at the time of opening up the telecom sector. Even if opinion is managed, pathway to a fair value estimate for the airline is muddied.

Air India is not listed and has not published its annual report for the last two financial years. In a report dated June 30, ICICI Securities analyst Anshuman Deb estimated the earnings before interest, tax, depreciation, amortisation and rent (EBITDAR) of Air India for 2016-17 at Rs. 3,500-4,000 crore using older numbers and accounting for the drop in fuel prices in the last two years that has buoyed the industry. Deb has used the ratio of EBITDAR margins to enterprise value (EV, which is based on share price) of listed aviation entities like Jet Airways (4) and Indigo (7.6). Applying the same ratios to the Air India EBITDAR, he arrived at an enterprise value for Air India in the range of Rs. 16,000 crore to Rs. 30,000 crore. The average EBITDAR to EV value for full-service Asian flag carriers is 6.5.

Nitin Bhasin, head of research at Ambit Equity, says the sheer value of Air India’s fully owned planes, taking an average of $45 million per aircraft (averaging out prices of narrow and wide-body planes and accounting for depreciation), would be Rs 20,000 crore. Its other assets (real estate alone is worth Rs 8,000 crore) can take its value up to rs 30,000 crore. There are intangible assets like prime landing slots at top airports across the world, but there is no one way of valuing them.

While these slots can be sold, value would differ if taken as a bunch or individually. Amber Dubey, a partner and head of aerospace and defence at KPMG, says there is immense value, not just in the intangibles but also in Air India’s fleet. “Forget about getting fresh landing slots, today you cannot even get new airplanes. To buy planes there is a wait-list of nine years.” Add to that Air India’s pool of engineers and pilots, especially the commanders who occupy the left-hand side seat of the cockpit. Plus, you have membership of Star Alliance, an international alliance of airlines that has Singapore Airlines, Lufthansa, United Airlines and China Air among its many members.

Promise of the Princelings

The debt on the books is another story — or may be the real one — taken on to acquire planes, often carrying a sovereign guarantee from the Government of India. If privatised, the guarantees will have to be replaced with bank guarantees. Bhasin of Ambit estimates that at least half of the debt or around Rs. 25,000 crore is working capital-related, so the government will have to find a way of retiring the remaining debt off its books. One surefire way is to sell the profit-making subsidiaries of the company first.

“In a high operating cost business, once you lose market share, it is difficult to come back. Air India should have been privatised when the aviation sector was opened up” Ajay Garg, founder & MD, Equirus Capital.

The Maharaja has promising progenies, many of which do not have the key personnel legacy issues of an ageing unionised workforce and undefined retirement benefits. Among the subsidiaries, there are highly profitable ones like Air India Express. Also, Air India enjoys a near-monopoly in ground handling as Indian rules allow only three players in each airport and AI is one among the three in every airport in India. For ground handling, apart from its own operation run by a subsidiary, Air India also has a 50:50 joint venture with Singapore Airlines that operates in the top modernised airports. Alliance Air, the regional airline, is also in a separate company and, although not as profitable as Air India Express, it is structured similarly, with low costs.

Then there is the maintenance arm or the MRO with its brand new unit in Nagpur which, if hived off, can easily survive on its own, offering services to all airlines. Edelweiss which, some years back advised SpiceJet for a qualified institutional placement, a fund-raising tool, is one of the growing mid-level investment banks. Vikas Khemani, CEO of Edelweiss Securities Ltd, says: “Air India is a behemoth and needs significant restructuring to make it an efficient and profitable enterprise. Divestment to strategic partners would be a better option as it will allow the freedom to revamp several issues the organisation is facing.” Dubey of KMPG too feels Air India, as it is now structured, is too big to sell as it is, and its assets must be unbundled, just as the Airports Authority did with the privatisation of Mumbai and Delhi airports.

Blind Men & a Large Entity

Whether to sell it unbundled or in its current form, is a question that many feel should have been answered first. And can foreign airlines participate in the process to take over Air India? “The government should have sounded out prospective buyers, asked them what they want and also spoken to us before making an announcement,” says the senior investment banker quoted earlier.

“Divestment to strategic partners would be a better option as it will allow the freedom to revamp several issues the organisation is facing” Vikas Khemani, CEO, Edelweiss Securities.

Qatar Airways is interested in India, and has even made a government-to-government pitch for starting a domestic airline in India. With Emirates and Etihad already invested in India, it is natural for Qatar to seek a foothold in the market. However, it has another objective: directing traffic to the Hamad International Airport that Doha opened in 2014. For the Tatas, of course, there is nostalgia, as they were involved in starting Air India International 70 years back. Even after the nationalisation of the airline, JRD Tata chaired the company’s board till 1978 when he was removed by the Janata Party government. He was back on the board two years later.

Indigo has already raised its hand, albeit with a caveat. Indigo and Air India have been in a bitter battle over fares and other issues and there is severe rivalry among the staff on the ground. Insider sources say the last thing Air India needs at this point is Indigo officials or bankers going through its books. An Air India spokesperson refused to participate in this story or comment on privatisation. Then there is so much disconnect between the lean and low-cost, single aircraft operations of Indigo and Air India’s configuration that the Indigo stock tanked 6% on June 30, after it announced its interest. Indigo promoters did an analyst call on Thursday to allay fears.

Khemani of Edelweiss says: “I don’t think it is about foreign or domestic players. It is about the commitment to run a large operation of this scale and financial muscle to deal with short-term issues. There are several domestic players who have both and will be interested in taking up the challenge.” To buy Air India with all its operations, a global player ideally must also be a member of Star Alliance. For an Indian operator, it can be a bigger challenge. “Maybe Mittal, maybe Reliance,” says Garg of Equirus.

Flag Carriers & their Routes to Privatisation

Privatisation of the national flag carriers can take many routes, starting from public issues of shares to induction of strategic partners. And they can go horribly wrong. Andrea Giurcin, a transport expert at Milan’s Bicocca University, has written a book, The Endless Privatisation of Alitalia, about the process that started in the ’90s and is yet to settle down. Alitalia filed for bankruptcy protection in the US in June.

British Airways (BA) was privatised through a share offering in 1987. Once seen as a successful endeavour, the company is again seen as a laggard, when compared with more nimble-footed competitors. Lufthansa, though listed since the 1960s was privatised in 1994, with shares being widely held. Japan Airlines was also privatised in a similar manner in 1987 and later merged with Japan Air Systems, making it the sixth largest in the world. Companies like BA and German Lufthansa have also participated in the privatisation of other flag carriers, joining them as strategic partners.

BA, for example had an 18% stake in the Australian airline Qantas, which it then sold off in the ’90s. Late last year Lufthansa took over Brussels Airlines, the Belgian flag carrier. It also took over Austrian Airlines in 2009. Flag carriers of France and the Netherlands, Air France and the KLM Royal Dutch Airlines, merged in 2004, effectively privatising Air France. Today the French government owns less than 20% of the airline. Nearer home, Air Sri Lanka saw a divestment of 40% stake to Dubai based Emirates back in 1998. The partnership ended in 2008 and the Emirates-appointed CEO was sacked, as the government took over full control of the airline. However, in the next few years the profitable venture ran up huge losses.

End of Article

FOLLOW US ON SOCIAL MEDIA