- News

- Business News

- India Business News

- PM Modi sets stage for reduction in GST rate on 25-30 items

Trending

This story is from December 19, 2018

PM Modi sets stage for reduction in GST rate on 25-30 items

The stage is set for a reduction in goods and services tax on 25-30 items — including air conditioners, dishwashers and digital cameras — over the weekend after Prime Minister Narendra Modi on Tuesday strongly hinted at only luxury goods being in the top slab of 28%, while bringing 99% of products and services in the 18% or lower brackets.

PTI photo

Key Highlights

- PM Modi on Tuesday strongly hinted at only luxury goods being in the top slab of 28%

- The government has repeatedly said it will look at reducing rates as collections improve and compliance rises

- Since GST kicked in over 17 months ago, the government has reduced taxes on around 320 items

NEW DELHI: The stage is set for a reduction in goods and services tax on 25-30 items — including air conditioners, dishwashers and digital cameras — over the weekend after Prime Minister Narendra Modi on Tuesday strongly hinted at only luxury goods being in the top slab of 28%, while bringing 99% of products and services in the 18% or lower brackets.

The government has repeatedly said it will look at reducing rates as collections improve and compliance rises.“Today, the GST system has been established to a large extent and we are working towards a position where 99% items will attract the sub-18% GST slab,” Modi said at an event in Mumbai on Tuesday.

When the GST Council meets on Saturday, rates are also expected to be pared on farmrelated products, such as irrigation sprinklers, and other items that currently face 18% tax. The list of items in the top slab has already been pruned from 226 when GST was launched in July 2017 to just 35 now.

For instance, a reduction in GST on cement alone will cost the exchequer Rs 20,000-25,000 crore annually and is fraught with the risk of a handful of manufacturers forming a cartel to gobble up the gains, with only a part of the benefits flowing to home buyers. A tax cut on the key building material has been on the radar for close to a year now but revenue considerations have held back the GST Council from actually reducing the levy.

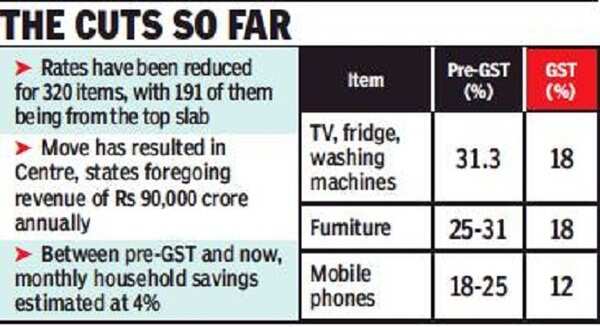

Since GST kicked in over 17 months ago, the government has reduced taxes on around 320 items, with 191 of them being removed from the 28% slab, resulting in the Centre and states foregoing revenue of around Rs 90,000 crore annually. But introduction of GST and subsequent reductions have significantly lowered burden on consumers.

For example, the levy on washing machines has reduced from over 31% before GST was launched to 18% now, while mobile phones have moved from 18-25% to 12% now. The PM also said the tax base has expanded significantly with the number of registered entities rising from 65 lakh when GST was implemented to around 1.2 crore now.

“We are of the opinion of making GST as smooth as possible for enterprises,” the PM said in what was a message to businesses complaining about implementation issues such as filing of returns. “In earlier days, the GST was framed according to the existing VAT or excise tax structures exercised in those respective states. (With) the discussions held from time to time, the tax system is improving,” Modi said.

“The country was demanding GST for decades. I am pleased to say that GST implementation has removed contradictions in the trade market and efficiency of system is improving. The economy is also getting transparent,” he added.

The government has repeatedly said it will look at reducing rates as collections improve and compliance rises.“Today, the GST system has been established to a large extent and we are working towards a position where 99% items will attract the sub-18% GST slab,” Modi said at an event in Mumbai on Tuesday.

When the GST Council meets on Saturday, rates are also expected to be pared on farmrelated products, such as irrigation sprinklers, and other items that currently face 18% tax. The list of items in the top slab has already been pruned from 226 when GST was launched in July 2017 to just 35 now.

The top GST slab includes automobiles, soft drinks, cigarettes, pan masala and tobacco products, yachts and aircraft for personal use and revolvers and pistols, which are strict “no go areas”. This leaves the government with the option of paring rates on some household appliances, cement, tyres and auto parts, amid indications the duty cut will be sequenced in a way that the burden on consumers reduces without impacting the Centre’s financial position.

For instance, a reduction in GST on cement alone will cost the exchequer Rs 20,000-25,000 crore annually and is fraught with the risk of a handful of manufacturers forming a cartel to gobble up the gains, with only a part of the benefits flowing to home buyers. A tax cut on the key building material has been on the radar for close to a year now but revenue considerations have held back the GST Council from actually reducing the levy.

Since GST kicked in over 17 months ago, the government has reduced taxes on around 320 items, with 191 of them being removed from the 28% slab, resulting in the Centre and states foregoing revenue of around Rs 90,000 crore annually. But introduction of GST and subsequent reductions have significantly lowered burden on consumers.

For example, the levy on washing machines has reduced from over 31% before GST was launched to 18% now, while mobile phones have moved from 18-25% to 12% now. The PM also said the tax base has expanded significantly with the number of registered entities rising from 65 lakh when GST was implemented to around 1.2 crore now.

“We are of the opinion of making GST as smooth as possible for enterprises,” the PM said in what was a message to businesses complaining about implementation issues such as filing of returns. “In earlier days, the GST was framed according to the existing VAT or excise tax structures exercised in those respective states. (With) the discussions held from time to time, the tax system is improving,” Modi said.

“The country was demanding GST for decades. I am pleased to say that GST implementation has removed contradictions in the trade market and efficiency of system is improving. The economy is also getting transparent,” he added.

End of Article

FOLLOW US ON SOCIAL MEDIA