- News

- City News

- surat News

- ‘Traders not allowed to put forth their grievance at GST open house’

Trending

This story is from July 14, 2018

‘Traders not allowed to put forth their grievance at GST open house’

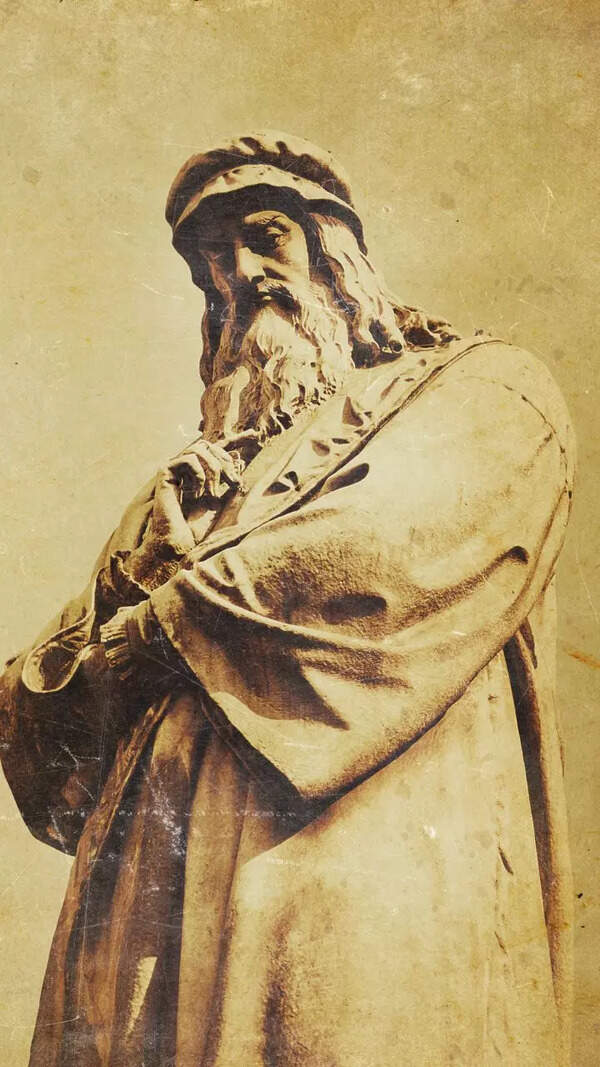

GST Open House organized by SGCCI where people from the trade and industry vent out their anger in the form of questions

SURAT: The power loom weavers and textile traders in the country’s largest man-made fabric (MMF) hub were highly annoyed when they were not given the chance to put forth their grievances at the open house on goods and service tax (GST) organized by the Central Board of Indirect Taxes and Customs (CBIC) at the Surat International Exhibition and Convention Centre (SIECC) in Sarsana on Friday.

The CBIC and the the Southern Gujarat Chamber of Commerce and Industry (SGCCI) had jointly organized a GST open house for South Gujarat at SIECC in Sarsana to understand the difficulties and grievances of the tax payers on Friday.

The power loom weavers and traders from city’s MMF sector were not allowed to speak about their difficulties and that the CBIC authorities insisted that they should give them in writing or send them emails to take up their demands in the upcoming GST council meeting.

The GST open house was attended by member CIBC Mahendra Singh, chief commissioner of central GST Ajay Jain, additional chief secretary and state GST commissioner P D Vaghela and other senior officials from the GST department of the state and central government on Friday.

The power loom sector has pointed out that individual knitters and power loom weavers are unable to sustain against the integrated unit due to the non-refund of ITC. Due to accumulation of duty credit, most of the job workers have lost their business and about 300 looms are scraped on a daily basis and 40 per cent of the knitting machines have become non-operational.

Further, the power loom industry leaders stated that the accumulation of ITC has resulted in fabrics being exported by merchant exporters as costlier to that of their counterparts in China, Vietnam and Bangladesh.

As per the study carried out by Ernst & Young, out of the total 24 lakh power looms in the country, about 8.5 lakh are into the decentralized MMF sector. Total employment in power looms in MMF sector is 18 lakh and the average ITC refund per loom per year comes to about Rs 10,000. However, the total ITC refund amount per year in decentralized MMF weaving sector comes to about Rs 750 crore.

President of Federation of Gujarat Weavers Association (FOGWA) Ashok Jirawala said, “We have been running between Gandhinagar and New Delhi from the last one year to get ITC refund. If they are not going to allow the refund, then we are prepared to shut down our units once and for all.”

Talking to TOI, SGCCI president Hetal Mehta said, “The SGCCI has strongly represented the CBIC to consider the refund of ITC for weaving sector and they have agreed to put the demand in the GST council. The textile sector is passing through a tough phase and many units have shut post GST.”

The CBIC and the the Southern Gujarat Chamber of Commerce and Industry (SGCCI) had jointly organized a GST open house for South Gujarat at SIECC in Sarsana to understand the difficulties and grievances of the tax payers on Friday.

The power loom weavers and traders from city’s MMF sector were not allowed to speak about their difficulties and that the CBIC authorities insisted that they should give them in writing or send them emails to take up their demands in the upcoming GST council meeting.

The GST open house was attended by member CIBC Mahendra Singh, chief commissioner of central GST Ajay Jain, additional chief secretary and state GST commissioner P D Vaghela and other senior officials from the GST department of the state and central government on Friday.

Leader of power loom weaving sector Ashish Gujarati said, “I had prepared a detailed presentation on the impact of GST on power loom weaving sector, but I was not allowed to speak. Power loom sector is on the brink of collapse and it is in the hands of the central government to approve the refund of input tax credit (ITC).”

The power loom sector has pointed out that individual knitters and power loom weavers are unable to sustain against the integrated unit due to the non-refund of ITC. Due to accumulation of duty credit, most of the job workers have lost their business and about 300 looms are scraped on a daily basis and 40 per cent of the knitting machines have become non-operational.

Further, the power loom industry leaders stated that the accumulation of ITC has resulted in fabrics being exported by merchant exporters as costlier to that of their counterparts in China, Vietnam and Bangladesh.

As per the study carried out by Ernst & Young, out of the total 24 lakh power looms in the country, about 8.5 lakh are into the decentralized MMF sector. Total employment in power looms in MMF sector is 18 lakh and the average ITC refund per loom per year comes to about Rs 10,000. However, the total ITC refund amount per year in decentralized MMF weaving sector comes to about Rs 750 crore.

President of Federation of Gujarat Weavers Association (FOGWA) Ashok Jirawala said, “We have been running between Gandhinagar and New Delhi from the last one year to get ITC refund. If they are not going to allow the refund, then we are prepared to shut down our units once and for all.”

Talking to TOI, SGCCI president Hetal Mehta said, “The SGCCI has strongly represented the CBIC to consider the refund of ITC for weaving sector and they have agreed to put the demand in the GST council. The textile sector is passing through a tough phase and many units have shut post GST.”

End of Article

FOLLOW US ON SOCIAL MEDIA