- News

- Business News

- India Business News

- Falling FD rates set to hit 4 crore senior citizens hard

Trending

This story is from October 10, 2019

Falling FD rates set to hit 4 crore senior citizens hard

On Wednesday, along with a cut in lending rates, banking major SBI also cut the FD rates for senior citizens for 1-2 years bracket to 6.9% from 7% while savings bank rate was cut to 3.25% from 3.5% for deposits of up to Rs 1 lakh. Other banks are expected to follow. Financial planners say senior citizens will have to take some risks and invest in debt funds.

Many senior citizens are dependent on deposits and savings in banks

Key Highlights

- On Wednesday, SBI cut the FD rates for senior citizens for 1-2 years bracket to 6.9% from 7%

- Move to sub-6% FD rates looks inevitable, experts say

- Financial planners say, senior citizens will have to take some risks and invest in marked-to-market products like debt funds

MUMBAI: Senior citizens and retirees who primarily depend on income from fixed deposits in banks, may soon need to look at shifting part of their life's savings into debt mutual funds.

On Wednesday, along with a cut in lending rates, banking major SBI also cut the FD rates for senior citizens for 1-2 years bracket to 6.9% from 7% while savings bank rate was cut to 3.25% from 3.5% for deposits of up to Rs 1 lakh.Other banks are expected to follow.

Thanks to the Reserve Bank of India (RBI), banks have moved to an external benchmark-the repo rate that is variable-to fix interest rates for their borrowers. With the lending rate being marked to a variable rate, now it's almost a given that the rate of interest on deposits will also be linked to the same variable benchmark.

In a falling interest rate scenario, when the RBI cuts repo rate to spur growth, FD rates are bound to fall, hurting those senior citizens and retirees dependent on FD income to meet their financial needs.

Alternately, the government has to step in to help senior citizens through tax concessions on the senior citizen savings scheme (SCSS) in which up to Rs 15 lakh could be parked by each individual of above 60 years, a report by SBI said.

Post SBI's cut, yield on an FD of Rs 50 lakh translates to a reduction in yearly income by Rs 5,000. SBI said that the rates have been cut 'given the surplus liquidity in the system'.

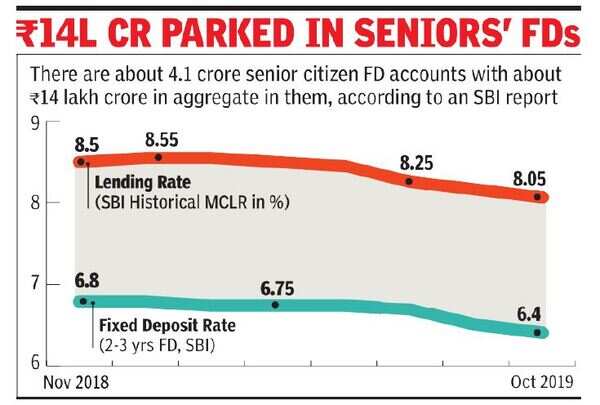

According to an SBI report, it is estimated that currently there are about 4.1 crore senior citizen FD accounts with about Rs 14 lakh crore in aggregate parked in them. All this money could be hit when these FDs are renewed at a lower rate and lead to resentment among depositors.

Earlier, speaking to TOI, PNB chief S S Mallikarjuna Rao had said that there is a limit below which rates can't be reduced. Repo rate has come down to the lowest level in the last nine-ten years and there is an indication it may reduce further. "In our country, if deposits go below 6%, there will be social uneasiness as many senior citizens depend on the interest income," he warned.

Speaking to TOI, Rajkiran Rai, MD, Union Bank of India, said: "Historically, inflation has been high at over 5%, which is why people are accustomed to 8% on fixed deposits. Now inflation is below 4% and deposit rates are in the range of 6-7% which means that real interest rates have not moved much," he said. He added that the feeling of discomfort is because people are not accustomed to low rates. "The other angle is that if the economy does not grow, everyone will be at a disadvantage," he said.

The move to sub-6% FD rates, however, looks inevitable. "Eventually, banks will have to move to a floating rate regime but in the short term the move will face a lot of resistance from depositors as they are not used to floating rate deposits," said Gajendra Kothari, MD & CEO, Etica Wealth Management.

According to Kothari, senior citizens should park Rs 15 lakh in SCSS and the balance in the government's 7.75% deposit schemes. However, both are currently taxable. In case the government does not give any tax sops to these schemes and FD rates are reduced farther, higher rated debt mutual funds, which offer about 7.5%-8% return, could turn out to be attractive investment avenues for senior citizens in the higher tax bracket. "A lot of money will start flowing to debt MFs as they have already been offering a higher floating rate return and with better diversification," Kothari said. "And if one is willing to park money for more than three years, the tax implications after indexation benefits will be very less."

When it comes to the need to maintain the same lifestyle while income from FDs is falling, investors could look at highly rated corporate FDs which are at least as good as the banks where the FDs were, said Surya Bhatia, managing partner, Asset Managers, a Delhi-based financial advisory outfit. The other alternative is to look at debt MFs that provide high safety with long-term capital gains (LTCG) benefits and have rundown maturity that lowers risks.

According to Bhatia, while looking for higher returns from new assets to match the reduced income from FDs, senior citizens should not compromise on three important aspects: Safety, return and liquidity. "Fit in where you can but don't compromise on any of the aspects," Bhatia said. "Don't chase return by compromising on the other two aspects."

On Wednesday, along with a cut in lending rates, banking major SBI also cut the FD rates for senior citizens for 1-2 years bracket to 6.9% from 7% while savings bank rate was cut to 3.25% from 3.5% for deposits of up to Rs 1 lakh.Other banks are expected to follow.

Thanks to the Reserve Bank of India (RBI), banks have moved to an external benchmark-the repo rate that is variable-to fix interest rates for their borrowers. With the lending rate being marked to a variable rate, now it's almost a given that the rate of interest on deposits will also be linked to the same variable benchmark.

In a falling interest rate scenario, when the RBI cuts repo rate to spur growth, FD rates are bound to fall, hurting those senior citizens and retirees dependent on FD income to meet their financial needs.

In such a scenario, say financial planners, senior citizens will have to take some risks and invest in marked-to-market products like debt funds.

Alternately, the government has to step in to help senior citizens through tax concessions on the senior citizen savings scheme (SCSS) in which up to Rs 15 lakh could be parked by each individual of above 60 years, a report by SBI said.

Post SBI's cut, yield on an FD of Rs 50 lakh translates to a reduction in yearly income by Rs 5,000. SBI said that the rates have been cut 'given the surplus liquidity in the system'.

According to an SBI report, it is estimated that currently there are about 4.1 crore senior citizen FD accounts with about Rs 14 lakh crore in aggregate parked in them. All this money could be hit when these FDs are renewed at a lower rate and lead to resentment among depositors.

Earlier, speaking to TOI, PNB chief S S Mallikarjuna Rao had said that there is a limit below which rates can't be reduced. Repo rate has come down to the lowest level in the last nine-ten years and there is an indication it may reduce further. "In our country, if deposits go below 6%, there will be social uneasiness as many senior citizens depend on the interest income," he warned.

Speaking to TOI, Rajkiran Rai, MD, Union Bank of India, said: "Historically, inflation has been high at over 5%, which is why people are accustomed to 8% on fixed deposits. Now inflation is below 4% and deposit rates are in the range of 6-7% which means that real interest rates have not moved much," he said. He added that the feeling of discomfort is because people are not accustomed to low rates. "The other angle is that if the economy does not grow, everyone will be at a disadvantage," he said.

The move to sub-6% FD rates, however, looks inevitable. "Eventually, banks will have to move to a floating rate regime but in the short term the move will face a lot of resistance from depositors as they are not used to floating rate deposits," said Gajendra Kothari, MD & CEO, Etica Wealth Management.

According to Kothari, senior citizens should park Rs 15 lakh in SCSS and the balance in the government's 7.75% deposit schemes. However, both are currently taxable. In case the government does not give any tax sops to these schemes and FD rates are reduced farther, higher rated debt mutual funds, which offer about 7.5%-8% return, could turn out to be attractive investment avenues for senior citizens in the higher tax bracket. "A lot of money will start flowing to debt MFs as they have already been offering a higher floating rate return and with better diversification," Kothari said. "And if one is willing to park money for more than three years, the tax implications after indexation benefits will be very less."

When it comes to the need to maintain the same lifestyle while income from FDs is falling, investors could look at highly rated corporate FDs which are at least as good as the banks where the FDs were, said Surya Bhatia, managing partner, Asset Managers, a Delhi-based financial advisory outfit. The other alternative is to look at debt MFs that provide high safety with long-term capital gains (LTCG) benefits and have rundown maturity that lowers risks.

According to Bhatia, while looking for higher returns from new assets to match the reduced income from FDs, senior citizens should not compromise on three important aspects: Safety, return and liquidity. "Fit in where you can but don't compromise on any of the aspects," Bhatia said. "Don't chase return by compromising on the other two aspects."

End of Article

FOLLOW US ON SOCIAL MEDIA